Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

Long term Capital Gain Tax on Share and Mutual fund | Excel Calculation to Find LTCG of Mutual fund - YouTube

Capital gains tax regime needs to be tweaked: Revenue secretary Tarun Bajaj | Business Standard News

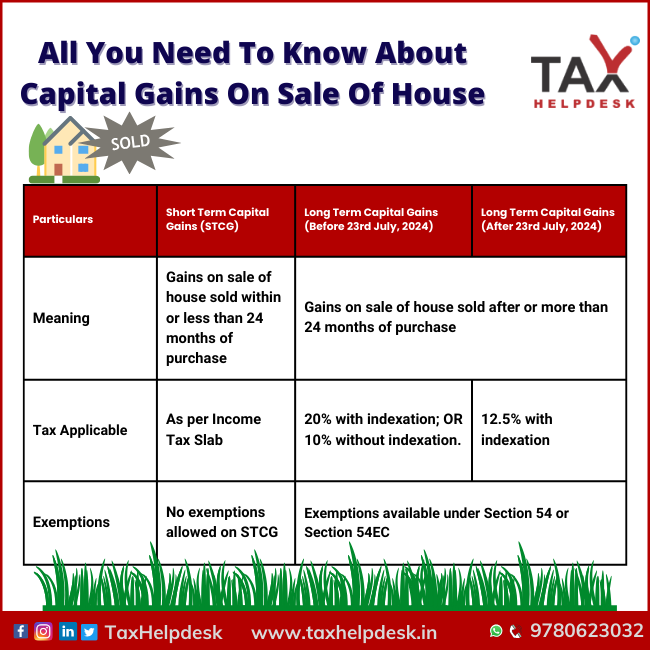

How to avail exemptions and save on long-term capital gains tax, from the sale of a residential house | Housing News